regional income tax agency estimated payments

From The Regional Income Tax Agency Municipal Income Tax Returns And Payments for Tax Year 2020 Deadline Extended to May 17th 2021. A Drop-off box is available and accessible Monday through Friday 730am 430pm.

Individuals Filing Due Dates Regional Income Tax Agency

Brecksville Office - 10107 Brecksville Road Brecksville Ohio 44141.

. 3282021 The Ohio Department of Taxation has extended the deadline to file and pay Ohio individual income tax for tax year 2020 from April 15th 2021 to May 17th 2021. As an employee at Regional Income Tax Agency in the USA you can expect to earn an average salary of 35191 per year or 1692 an hour. Extensions of time to file have no effect on the due dates of the 2019 estimated taxes.

How Much Does Regional Income Tax Agency Pay. Ad Paros Tax Service Experts Will Ensure You File Accurately Optimally and On Time. If you file on an extension your first 2019 estimated tax payment is still due April 15 2019.

The filing of your municipal income tax return by completing Form 32-EXT Estimated Income Tax andor Extension of Time to File which is due on or before April 18 2017. Individual Estimated Income Tax andor Extension of Time to File. Regional Income Tax Agency.

Salary information comes from 53 data points collected directly from employees. Ifyou file on an extension and you expect to owe estimated taxes for 2019 remit your first quarter estimated payment. Call 212-NEW-YORK or 212-639-9675 Out-of-City TTY 212-639-9675 Hearing Impaired Cash Bail.

The Regional Income Tax Agency RITA collects and distributes income tax for the municipalities listed on page 8 of these instructions. Available 24 hours New York City Personal Income Tax and Sales Tax. 5 REGIONAL INCOME TAX AGENCY Net Profit Estimated Income Tax andor Extension of Time to File.

All 24 Maryland counties levy income taxes on both residents and nonresidents. The Regional Income Tax Agency RITA collects and distributes income tax for the municipalities listed on pages 7-8 of these instructions. Request for Allocation of Payments.

The city of Baltimore also has an income tax of 32. Achieve Your Goals By Using The Right Services Subject Expertise For Your Business. Implicit tax rates priced in the cross section of municipal bonds are approximately two to three times as high as statutory income tax rates with implicit tax.

29 out of 5 stars. The lowest-paid workers at Regional Income Tax Agency make. New York State Department of Taxation and Finance.

There is a significant gap between the bottom 10 percent of earners and the top 10 percent of earners. Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. Form 32-EXT to pay your tax balance due.

Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. Tax rates range from 225 in Worcester County to 320 in Baltimore County Caroline Dorchester Howard Kent Montgomery Prince Georges Queen Annes Somerset Washington and Wicomico Counties in 2022. An extension to file is not an extension to pay - the tax you owe is still due by April 18 2017.

Of estimated tax payments and credits on your account or make a payment by calling 440-526-0900 or 800-860-7482. Line 1 must equal Line 6 2Less Prior Year Credit 00 3. Broadview Heights OH 44147-7900.

Delivery options for this form are found on the bottom of the first page. All groups and messages. As a result the.

If youd like a CCA team member to complete your municipal income tax return please fill out the CCA Division of Taxation Taxpayer Assistance Form found on the Tax Forms page of this website. Tax Refunds 1.

Defense Finance And Accounting Service Civilianemployees Civilian Permanent Change Of Station Pcs Civilian Pcs Entitlement Guide Relocation Income Tax Allowance Rita

Canadian Tax News And Covid 19 Updates Archive

Personal Income Taxes In Canada Revenue Rates And Rationale Hillnotes

When Can I File My 2021 Taxes In Canada Loans Canada

![]()

The Regional Council Of Governments Regional Income Tax Agency

![]()

Rita Municipalities Regional Income Tax Agency

T1 Vs T4 Tax Form What S The Difference

Individuals Filing Due Dates Regional Income Tax Agency

Ohio Regional Income Tax Return Rita Support

2021 Tax And Rate Budgets City Of Hamilton Ontario Canada

Income Tax City Of Gahanna Ohio

The Lakefront City City Of Euclid

Finance And Income Tax Waterville Ohio

Solon Municipal Income Tax Solon Oh Official Website

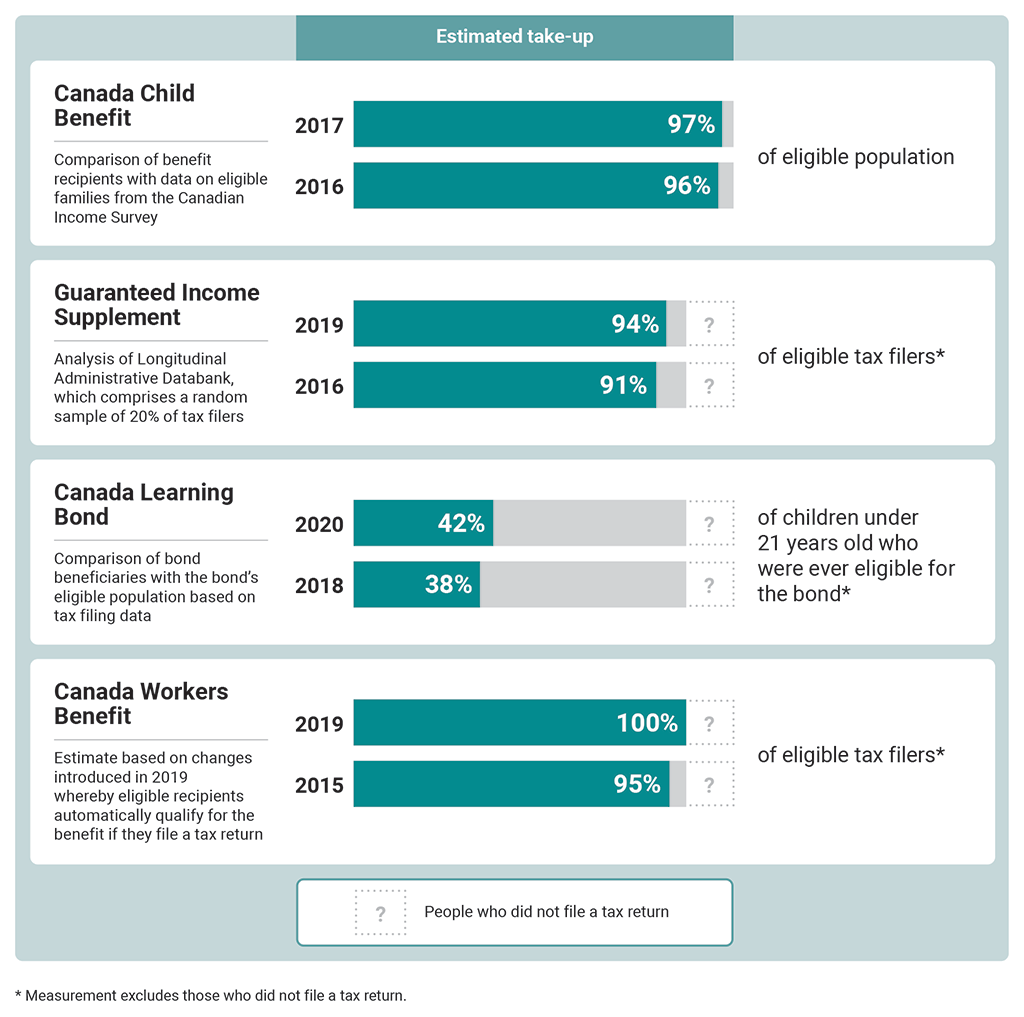

Report 1 Access To Benefits For Hard To Reach Populations

![]()

Individuals Estimated Tax Payments Regional Income Tax Agency

Finance And Income Tax Waterville Ohio

![]()

The Regional Council Of Governments Regional Income Tax Agency